By: Coleman Jackson, Attorney, and Certified Public Accountant

December 11, 2018

Internal Revenue Code Section 6012(b)(1) states that “[t]ax returns of decedents are to be made by the decedent’s executor, administrator, or other person charged with the property of the decedent.” A person having charge of the decedent’s property means a person who has lawful possession, custody or control of the decedent’s property. This person would typically be a surviving spouse, son or daughter or a court appointed executor. The person charged with the property of the decedent could also be a trustee of the decedent’s trust.

The decedent’s last tax return is due by the same filing deadlines that would have applied if the decedent had not died if the applicable tax return filing income thresholds were met at the time of decedent’s death. The filer should put the decedent name, taxpayer identification number, the fact that the decedent is deceased, and the date of death of the decedent on the top of the tax return. The return should be signed by the decedent’s executor, administrator, or other person in possession, custody or control of the decedent’s property.

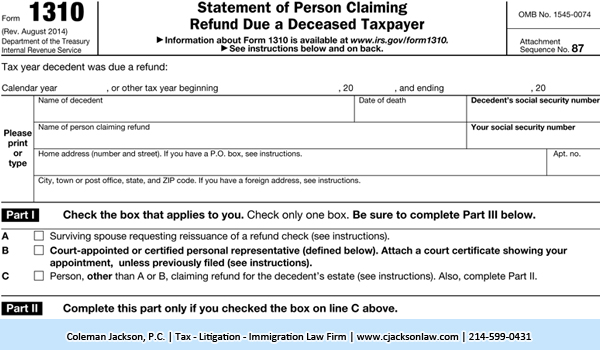

If the filer is seeking to recover a tax credit or refund, the IRS may require the filer to submit documentary proof of their legal authority to file the return or receive the tax refund. Form 1310 should be filed with the IRS when seeking a decedent’s tax credit or refund.

This law blog is written by the Taxation | Litigation | Immigration Law Firm of Coleman Jackson, P.C. for educational purposes; it does not create an attorney-client relationship between this law firm and its reader. You should consult with legal counsel in your geographical area with respect to any legal issues impacting you, your family or business.

Coleman Jackson, P.C. | Taxation, Litigation, Immigration Law Firm | English (214) 599-0431 | Spanish (214) 599-0432