ኮልማን ጃክሰን ፒ.ሲ

4/3/2023

በመጀመሪያ ስለ ግዜያዊ የደህንነት ጥበቃ ስታተስ ምንነት እናስረዳዎመመርያ፡

ግዜያዊ የደህንነት ጥበቃ ስታተስ በምህጻረ ቃል (TPS) እንደ ግርጎሳርያን አቆጣጠር በ1980 የዩናይትድ ስቴትስ ኦፍ አሜሪካ ኮንግረስ የተቋቋመ ሲሆን አላማውም በሰው ሰራሽ እና በተፈጥሮአዊ ምክንያቶች ምክንያት ከአሜሪካ ውጭ ያሉ ዜጎችን ለሚያጋትማቸው የስነልቦናዊ ፣ መሃበራዊ ፣ አካላዊ እንዲሁም ኢኮኖምያዊ ቀውሶች የሰብአዊ ድጋፍ አና እፎይታ ለመስጠት ያለመ ነው።

የደህንነት ጥበቃ ስታተስ(TPS) ምንድን ነው?

የደህንነት ጥበቃ ስታተስ(TPS) የትውልድ አገራቸው ደህንነታቸው ያልተጠበቀ ነው ተብለው የሚታሰቡ ስደተኞች ለጊዜው፣ ግን ረዘም ላለ ጊዜ በዩናይትድ ስቴትስ የመኖር እና የመስራት መብት የሚፈቅድ ፕሮግራም ነው። እንደ ህጋዊ ቋሚ ነዋሪ ወይም የአሜሪካ ዜጎች ባይቆጠሩም ብዙዎቹ በዩናይትድ ስቴትስ ውስጥ ከሃያ ዓመታት በላይ ኖረዋል። የደህንነት ጥበቃ ስታተስ(TPS) በአደጋ ምክንያት ወደ አገራቸው መመለስ ለማይችሉ ሰዎች ነው። እነዚህም የትጥቅ ግጭት፣ የአካባቢ አደጋዎች ወይም ሌሎች ጊዜያዊ አደጋዎችን ሊያካትቱ ይችላሉ። ይህ ጥበቃ(status) የሚገኘው ዜግነት ለሌላቸው ዜጎች እና ግለሰቦች በተሰየመው ሀገር ውስጥ ለዘለቄታው ለቆዩ ብቻ ነው።

የሃገር ውስጥ ደህንነት ክፍል (DHS) ፀሃፊ የአሜሪካ መንግስት የመሾም ስልጣን ነው። ጸሃፊው ኢትዮጵያን ለጊዜያዊ ጥበቃ ሁኔታ (TPS ለ18 ወራት ከታህሳስ 12 ቀን 2022 ጀምሮ እስከ ሰኔ 12 ቀን 2024 ድረስ) ሾመ።

የ TPS ጥቅሞች ምንድ ናቸው?

- በዩኤስኤ ውስጥ ለተወሰነ ጊዜ በህጋዊ መንገድ መቆየት ይችላሉ።

- በዩኤስኤ ውስጥ ለስራ ፍቃድ ማመልከት ይችላሉ።

- ከዩኤስኤ ውጭ ለመጓዝ ሰነድ ማመልከት ይችላሉ።

- ከመታሰር እና ከመባረር ይጠበቃሉ።

- ከሌላ የስደት ሁኔታ ጋር በተመሳሳይ ጊዜ TPS ሊኖርዎት ይችላል። ለእነዚያ የኢሚግሬሽን ጥቅማጥቅሞች መስፈርቶችን ካሟሉ ለጥገኝነት፣ ህጋዊ የቋሚ ነዋሪነት ሁኔታ (Green Card) ወይም ሌላ የተጠበቀ ሁኔታ ማመልከት ይችላሉ።

የደህንነት ጥበቃ ስታተስ(TPS) እንዴት ነው የሚሰራው?

አንድ ሀገር የTPS ስያሜ ከተቀበለች በኋላ ማንኛውም የዚያ ሀገር ዜጋ በአካል በዩናይትድ ስቴትስ ውስጥ የሚገኝ በአሜሪካ የዜግነት እና የኢሚግሬሽን አገልግሎት (USCIS)፣ የDHS ኤጀንሲ የተወሰኑ መስፈርቶችን ካሟሉ ለፕሮግራሙ ማመልከት ይችላሉ። ውድቅ የሚያደርጉ ምክንያቶች በዩናይትድ ስቴትስ ውስጥ የወንጀል ፍርዶች እና በሽብርተኝነት እንቅስቃሴዎች ውስጥ መሳተፍ ያካትታሉ።

የአንድ ሀገር TPS ስያሜ የመስጠት ስልጣን በአገር ውስጥ ደህንነት ዲፓርትመንት ፀሃፊ የተያዘ ነው፣ እሱም በአገሪቱ ውስጥ ያሉ ሁኔታዎች ግለሰቦች በሰላም ወደ ቤታቸው እንዳይመለሱ የሚከለክል ከሆነ ላልተወሰነ ጊዜ ማራዘም ይችላል። የ TPS መሰየሚያ ምክንያቶች የሚከተሉትን ያካትታሉ:

- እንደ የእርስ በርስ ጦርነት ያለ ቀጣይነት ያለው የትጥቅ ግጭት;

- እንደ የመሬት መንቀጥቀጥ, አውሎ ንፋስ, ድርቅ ወይም ወረርሽኝ የመሳሰሉ የአካባቢ አደጋዎች; እና ሌሎች ሀገሪቱን ከአደጋ የሚያጋጩ ያልተለመዱ እና ጊዜያዊ ሁኔታዎች።

የአንድ ሀገር ስያሜ አንዴ ካለቀ ግለሰቦች TPS ከመቀበላቸው በፊት ወደ ያዙት የኢሚግሬሽን ሁኔታ ይመለሳሉ፣ ይህም ለአብዛኛዎቹ ስደተኞች ወደ ህጋዊ ፍቃድ መመለስ እና ወደ ትውልድ ሀገራቸው የመባረር ስጋትን መጋፈጥ ማለት ነው። ብቁ ከሆኑ ለስራ ወይም ለተማሪ ቪዛ ማመልከት ይችላሉ፣ ምንም እንኳን እነዚያ ጊዜያዊ ናቸው። ነገር ግን፣ እነዚያ የ TPS ስደተኞች የትዳር ጓደኞቻቸው ወይም ጎልማሳ ልጆቻቸው ዜጎች ወይም ህጋዊ ቋሚ ነዋሪ የሆኑ የስደተኛ አቤቱታ ሲፈቀድላቸው በህጋዊ መንገድ በአገር ውስጥ ለመቆየት ብቁ ሊሆኑ ይችላሉ። አንዳንድ አሰሪዎች የ TPS ሰራተኞችን በመወከል የስደተኛ አቤቱታዎችን ማቅረብ ይችላሉ። ስለዚህ፣ የTPS ስደተኞች በዩናይትድ ስቴትስ ውስጥ ለመቆየት እና ለመስራት ብዙ አማራጭ መንገዶች ሊኖራቸው ይችላል TPS ሁኔታቸው በሚያልቅበት ጊዜም እንኳ።

አሁን ትኩረታችንን ወደ አሜሪካ የኢትዮጵያ ግዜያዊ የደህንነት ጥበቃ ስታተስ እናዙር የደህንነት ጥበቃ ስታተስ(TPS)ን ለኢትዮጵያ የሾመው ማን ነው?

እ.ኤ.አ ኦክቶበር 21፣ 2022 የአገር ውስጥ ደህንነት መምሪያ (ዲኤችኤስ) አሁን ባለው ሁኔታ TPSን ለኢትዮጵያ ሰይሟል። የፌደራል መመዝገቢያ ማስታወቂያ ከተጋራበት ጊዜ ጀምሮ ደረጃው ለ18 ወራት ይቆያል። DHS እየተካሄደ ያለውን የትጥቅ ግጭት እና በኢትዮጵያ ውስጥ ያለውን ያልተለመደ እና ጊዜያዊ ሁኔታዎችን ይገነዘባል። ይህ ስያሜ የተመሰረተው በኢትዮጵያ ውስጥ እየተካሄደ ባለው የትጥቅ ግጭት እና የኢትዮጵያውያን እና ምንም አይነት ዜግነት የሌላቸው ኢትዮጵያውያን በሰላም ወደ ኢትዮጵያ እንዳይመለሱ በሚከለክሉ ልዩ እና ጊዜያዊ ሁኔታዎች ላይ ነው። በትጥቅ ግጭት ምክንያት፣ ሲቪሎች ከግጭት ጋር በተያያዙ ጥቃቶች፣ ጥቃቶች፣ ግድያዎች፣ አስገድዶ መድፈር እና ሌሎች ጾታ-ተኮር ጥቃቶችን ጨምሮ ለአደጋ የተጋለጡ ናቸው። በዘር ላይ የተመሰረተ እስራት; እና የሰብአዊ መብት ጥሰቶች እና ጥሰቶች. ዜጎቹን በደህንነት ወደ መጡበት እንዳይመለሱ የሚከለክሉት ያልተለመዱ እና ጊዜያዊ ሁኔታዎች ከፍተኛ የምግብ ዋስትና እጦት፣ የጎርፍ መጥለቅለቅ፣ ድርቅ፣ መጠነ ሰፊ መፈናቀል እና የበሽታ መከሰት ተጽእኖን ያካተተ ሰብአዊ ቀውስ ይገኙበታል።

ለማመልከት ብቁ የሆነው ማነው?

በዩኤስሲአይኤስ መሰረት፣ በኢትዮጵያ ስያሜ ለTPS ብቁ የሆኑ ግለሰቦች ከኦክቶበር 20፣ 2022 ጀምሮ ያለማቋረጥ በዩናይትድ ስቴትስ መኖር አለባቸው። ከኦክቶበር 20፣ 2022 በኋላ ወደ አሜሪካ ለመጓዝ የሚሞክሩ ግለሰቦች በዚህ ስያሜ ለTPS ብቁ አይሆኑም። የኢትዮጵያ የ18 ወራት ጊዜያዊ የጥበቃ ሁኔታ ስያሜ ከታህሳስ 12 ቀን 2022 ጀምሮ ተግባራዊ ይሆናል እና በጁን 12፣ 2024 ያበቃል። ማንኛውም ሰው ለTPS በተሰየመው ጊዜ ውስጥ ማመልከት አለበት።

ለመጀመሪያ ጊዜ የሚያመለክቱ ከሆነ የሚከተሉትን መስፈርቶች ማሟላት አለብዎት:

- የኢትዮጵያ ዜግነት ያለው ወይም ዜግነት የሌለው ሰው ሁን ኢትዮጵያ ውስጥ ለረጅም ጊዜ የኖረ አሜሪካ ከመግባቱ በፊት

- ከኦክቶበር 20፣ 2022 ጀምሮ ያለማቋረጥ የኖሩት በዩኤስኤ ውስጥ ብቻ ነው።

- ከኦክቶበር 20፣ 2022 ጀምሮ ከአሜሪካ አልወጡም።

እንዴት ማመልከት ይቻላል?

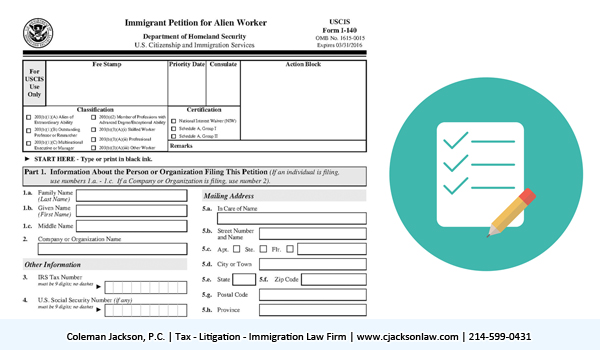

ለTPS ኢትዮጵያ ፎርም I-821፣ ለጊዜያዊ ጥበቃ ሁኔታ ማመልከቻ በማስገባት ማመልከት ይችላሉ። እንዲሁም ማመልከቻዎን ከUSCIS ጋር በመስመር ላይ ማስገባት ይችላሉ። በዩናይትድ ስቴትስ ኦክቶበር 20, 2022 ያለማቋረጥ ስለመኖርዎ የማንነትዎ፣ የዜግነትዎ፣ የመግቢያ ቀንዎ እና ማስረጃዎቸን የሚያሳዩ ሰነዶችን መላክ አለቦት። ለመጀመሪያ ጊዜ ለTPS የሚያመለክቱ ከሆነ ክፍያ መክፈል አለብዎት። የመጀመርያው የTPS ማቅረቢያ የአሁኑ የማመልከቻ ክፍያ $50 እና $85 የባዮሜትሪክ ክፍያ ነው። ክፍያውን ለመክፈል አቅም ከሌለዎት ለክፍያ ማቋረጫ ማመልከት ይችሉ ይሆናል.

በተጨማሪም ቅጽ I-821 በፋይሊንግ ቅጽ I-765፣ የቅጥር ፍቃድ ማመልከቻ ቅጽ በሚያስገቡበት ጊዜ በተመሳሳይ ጊዜ ለሥራ ስምሪት ፈቃድ ማመልከት ይችላሉ። በአሁኑ ጊዜ ለመጀመሪያው ሥራ ፈቃድ የማመልከቻ ክፍያ 410 ዶላር ነው።

የደህንነት ጥበቃ ስታተስ(TPS) የማስኬጃ ጊዜ?

አሁንም ለኢትዮጵያ TPS የተወሰነ የሂደት ጊዜ የለም፣ ነገር ግን ሌሎቹን ከግምት ውስጥ በማስገባት ሂደቱ ለመጠናቀቅ አምስት ወር ተኩል አካባቢ ይወስዳል።

እንደኛ የህግ ድርጅቶች ማመልከቻዎን እንዲያጠናቅቁ፣ ማስረጃዎችን የሚደግፉ ሰነዶችን እንዲያሰባስቡ ሊያማክሩዎት እና ሁሉንም ሊሆኑ የሚችሉ የኢሚግሬሽን አማራጮችን መገምገም ይችላሉ። በኢትዮጵያ ያለው የአሜሪካ ኤምባሲ ተጨማሪ መረጃ ሊሰጥ ይችላል። የዩኤስ የኢትዮጵያ ኤምባሲ በ (202) 364-1200 ማነጋገር ወይም በዋሽንግተን ዲሲ፣ ሎስ አንጀለስ፣ ሲኤ እና ሴንት ፖል ሚኒሶታ የሚገኘውን የቆንስላ ጽ/ቤቱን መጎብኘት ይችላሉ። USCIS በአስከፊ ሁኔታዎች የተጎዱ ሰዎችን የሚረዱ ሌሎች የኢሚግሬሽን አገልግሎቶችን ይሰጣል። እርዳታ ለመጠየቅ 800-375-5283 ይደውሉ።

ማሳሰብያ፡ ሁሉም የመንግስት አድራሻ መረጃ ለብሎግ አንባቢዎቻችን በትህትና ቀርቧል። ይህ ብሎግ ለመጀመሪያ ጊዜ ከታተመበት ቀን ጀምሮ ትክክለኛ ነው ብለን እናስባለን። የእኛ የህግ ኩባንያ ከUS መንግስት ወይም ከማንኛውም መንግስት ጋር ምንም ግንኙነት የሌለው የግል የህግ ኩባንያ ነው።

የአርሊንግተን አካባቢ የዜግነትና የኢሚግሬሽን ጠበቃ

እርስዎም ሆኑ ወይም የቅርብ ዘመድዎ የኢሚግሬሽን ችግር ካለብዎት፤ በስልክ ቁጥር 214- 599 – 0431 ስራ ቦታ ደውለው ቀጠሮ ይያዙ እንዲሁም ድህረ ገጻችን

http://www.cjacksonlaw.com/ በመሄድ ሊያገኙን ይችላሉ

በአማሪኛ፤ በትግርኛና፤ በስፓኒሽ ቛንቛ የሚያነጋግሩ ሰራተኞች አሉን።